The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract https://allaboutfireprotection.net/. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

NFTs are multi-use images that are stored on a blockchain. They can be used as art, a way to share QR codes, ticketing and many more things. The first breakout use was for art, with projects like CryptoPunks and Bored Ape Yacht Club gaining large followings. We also list all of the top NFT collections available, including the related NFT coins and tokens.. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. NFTs are a new and innovative part of the crypto ecosystem that have the potential to change and update many business models for the Web 3 world.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

Cryptocurrency was invented by Satoshi Nakamoto, which is the pseudonym used by the inventor of Bitcoin. Even though digital currency concepts existed before Bitcoin, Satoshi Nakamoto was the first to create a peer-to-peer digital currency that reliably solved the issues facing previous digital money projects. Bitcoin was initially proposed in 2008 and launched in early 2009. Following the invention of Bitcoin, thousands of projects have attempted to imitate Bitcoin’s success or improve upon the original Bitcoin design by leveraging new technologies.

Sophie is a dedicated Web3 writer, specializing primarily in the field of cryptocurrency casinos. With a strong passion for digital innovation, Sophie began delving into the crypto world in 2016, fascinated by the potential of blockchain technology to revolutionize online gambling. Her expertise lies in dissecting the latest trends and developments in crypto casinos, offering readers insightful analysis and practical guides.

Crypto casinos, often known as Bitcoin casinos or crypto gambling sites, mirror their traditional counterparts in many ways. For instance, these cryptocurrency casinos offer an extensive range of popular casino games the same as traditional fiat real money online casinos do, allowing players to engage in the excitement of winning using crypto money while having fun. The primary point of divergence lies in the payment methods offered by these unique casinos.

Yes, people can and do win big in Bitcoin casinos. Similar to long-established casinos online, Bitcoin casinos offer a range of games such as poker, slots, and roulette, where players can win substantial amounts. Some Bitcoin casinos even have progressive jackpots where the prize pool increases over time until someone wins, which can result in enormous payouts.

Many online casinos have embraced the advantages of Bitcoin and other digital currencies, creating an enhanced and immersive gaming experience. However, with so many options out there, it can be challenging – especially for newcomers – to figure out which crypto and Bitcoin casinos are truly the best.

Playing in an online casino means you risk your real money. That’s why it’s recommendable to understand the rules and gameplay of individual casino games before wagering real cash. Casino Guru offers a wide selection of free casino games you can try out before playing in a real casino.

The fees become more important, the more cryptocurrency you exchange. The lowest fees can be found at exchanges with high volume order books. To get the lowest fee you should buy/sell with a limit order.

(At the bottom of this page you will find frequently asked questions and answers. For example, we answer the questions: Is cryptocurrency legal? Why do Bitcoin have value? How do I buy cryptocurrency? Which exchange has the lowest fees?)

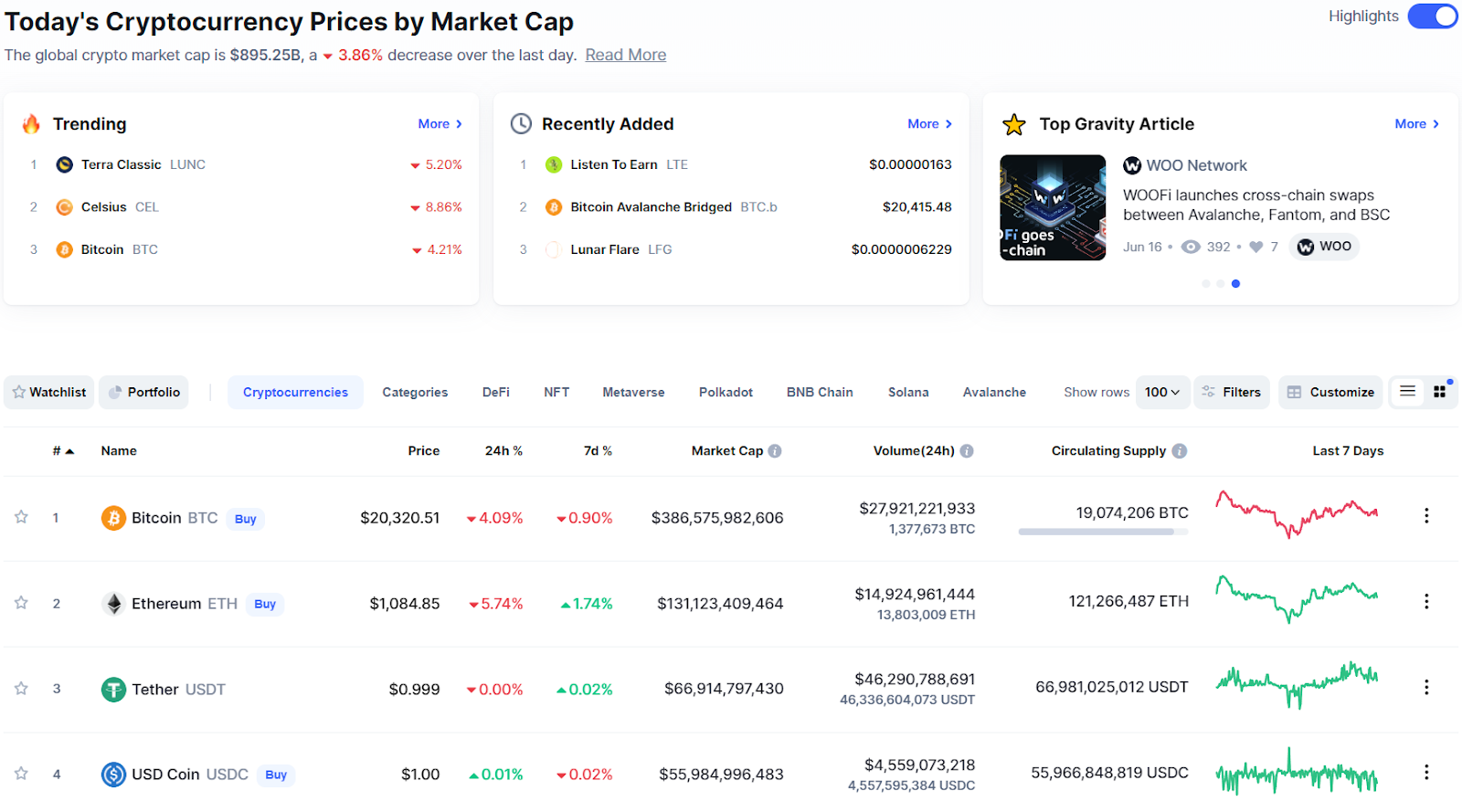

Welcome to CoinMarketCap.com! This site was founded in May 2013 by Brandon Chez to provide up-to-date cryptocurrency prices, charts and data about the emerging cryptocurrency markets. Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. We take our data very seriously and we do not change our data to fit any narrative: we stand for accurately, timely and unbiased information.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

The fees become more important, the more cryptocurrency you exchange. The lowest fees can be found at exchanges with high volume order books. To get the lowest fee you should buy/sell with a limit order.

(At the bottom of this page you will find frequently asked questions and answers. For example, we answer the questions: Is cryptocurrency legal? Why do Bitcoin have value? How do I buy cryptocurrency? Which exchange has the lowest fees?)

Altcoins, or alternative cryptocurrencies, have gained significant traction in recent years. Many of these coins offer unique features that set them apart from bitcoin. For instance, Ethereum introduced smart contracts, enabling decentralized applications (dApps) to flourish. Similarly, Solana and Cardano focus on scalability and energy efficiency, addressing some of the limitations of earlier cryptocurrencies.

Forks can also lead to uncertainty. When a blockchain splits into two versions, investors may hesitate, unsure of which version will gain traction. Bitcoin Cash, created from a bitcoin fork in 2017, saw initial volatility before stabilizing. Upcoming upgrades, like the Chang Hard Fork expected in 2024, are predicted to spark bullish trends based on historical patterns. These events demonstrate how technological changes can influence cryptocurrency prices both positively and negatively.

Many cryptocurrencies, including bitcoin, have a fixed supply. For instance, bitcoin has a maximum supply of 21 million coins, with approximately 19.5 million already in circulation. This scarcity plays a significant role in its value. When supply is limited and demand increases, prices tend to rise. On the other hand, if demand drops, even a limited supply may not prevent a price decline.

Government policies can either boost or hinder the cryptocurrency market. For instance, after the U.S. presidential election, bitcoin’s price surged from $67,000 to over $104,000, while Ethereum also saw a sharp rise. This trend reflected growing optimism about potential regulatory clarity. Similarly, the establishment of a “Strategic Bitcoin Reserve” caused slight price increases, showing how government actions can sway market sentiment.

Cryptocurrency trading is done through Lunar Block. Lunar Block is not regulated by the Danish Financial Supervisory Authority (Finanstilsynet). That means you won’t have the same protection as when trading e.g. stocks or other regulated assets.

..

..

..

..

..

..

Zrozumienie mechaniki automatów rodzaju Hot Spot jest to pierwszy chód do cze..

..

..

..